So following my post that states that BOC have higher interest rates as compared to OCBC 360 account, I have decided to open a BOC account in hope to gain the additional interest.

While it is true that BOC have a pretty awesome offering in credit card (BOC Family Card), and that it has higher interest rates, i ended up still didn't switch over for my salary crediting.

Firstly, as i have previously stated here, interest my key concern is still if it is "user friendly".

Since i now stay at Punggol, and travels to Pioneer pretty often (GF stays there), I have no issues with finding ATMs as Waterway Point, Jurong WestGate and Pioneer Jurong Point all have Bank of China Branches.

However, the ibanking needs to mature before users will start to jump over.

First and foremore, the ibanking site does not work on mobile phone. This meant that you need to do transactions only on a Computer.

As of 18th Sept, you can choose to login via OTP service already!

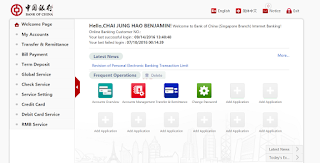

Have a look at after i logged in!

It still looked okay apart from some directly translated English.

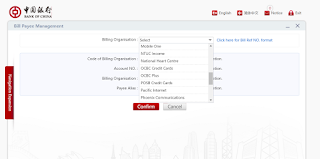

My biggest pain point would be to earn that last portion of percent by doing ibanking.

These are the only organisations we can pay our bills to.

You see, my current 3 bills with OCBC happened to be

Citibank M1 card (for m1 bills)

OCBC 365 card (for normal usage)

Amex true cashback (for usage where ocbc have no rebates on)

Even if I change, it would only be that the OCBC card be replaced by the BOC family card, since both needs to have a minimum spending of $500.

Again, please look at your personal usage pattern!

it might suit you!!

and oh, using UNION PAY gets 1 for 1 movie tickets at Shaw Theatres (both Waterway point and Jcube have them!)

The call center is pretty weak in english.

Regards

Benjamin Chai